Medical negligence claim solicitors

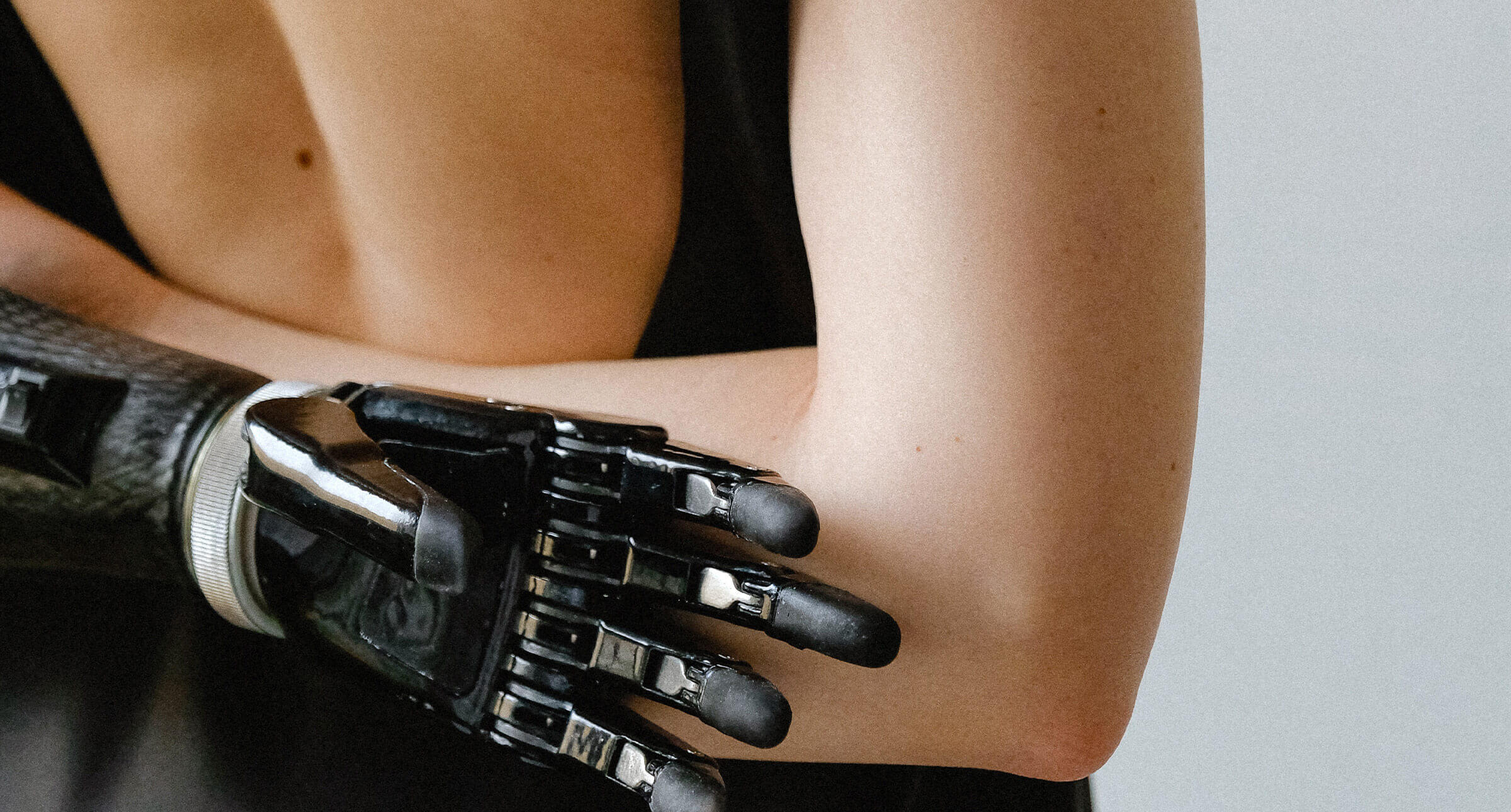

If you suffer an injury caused by medical negligence, it can have a devastating impact. At what is a distressing time, you need to count on expert help. That's where we come in.

- No Win No Fee funding available

- We can help find the right support for you

- Track record of successful claims

- Experts in a wide variety of claims

Experts in medical negligence claims. Here for you when the worst happens.

We listen before we speak. We speak your language. And we work with you every step of the way. Because that’s how we succeed. Together.

To be successful, you need professional support and guidance on your side. We know the steps to take, the amount of medical negligence compensation you should expect, and how to quickly secure this for you while maximising it.

Everything we do is focused on helping you through the process. We know time is precious and we work hard to progress things as fast as possible.. So you can get on with the important stuff like starting to rebuild your life.

“I would recommend you to anyone who needs help and advice with medical law as I found you easy to talk to and you went through all the options I could take and nothing was too much trouble”.

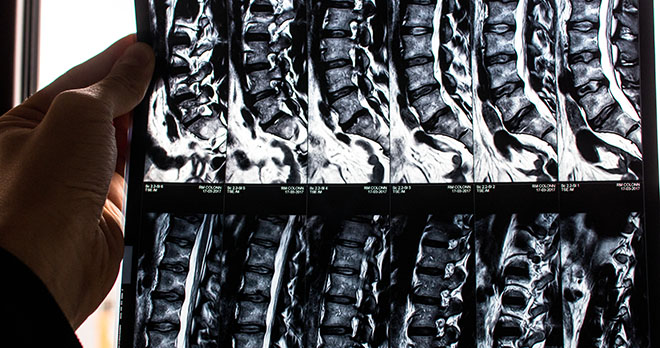

Understanding your medical negligence claim

Our expert team will help you understand what constitutes medical negligence, and whether you can make a claim.

We can also explain what level of damages and how much compensation for medical negligence you can expect should your claim be successful.

Our team sees a claim both as an opportunity to secure the future for you (and/or your family) and to throw a spotlight on vital patient safety lessons for medical institutions, avoiding further instances of substandard care.

Your medical negligence claims and compensation is our priority. As medical negligence solicitors, we’ve been helping clients make successful claims for decades, and pride ourselves on getting to grips with the complex needs of every case to deliver a speedy resolution. You can count on us for specialist knowledge, unparalleled commitment and a down-to-earth approach.

Call us now for a free consultation

Where you can find us

Our solicitors act for clients across England & Wales, however we do also have a number of offices in which you can come and see us: